When you’re strapped for cash, and you have a credit card payment coming up, it can be tempting to just pay the minimum required payment on the bill.

When you’re strapped for cash, and you have a credit card payment coming up, it can be tempting to just pay the minimum required payment on the bill.

But you should always try to pay more than the minimum required payment. Here’s why:

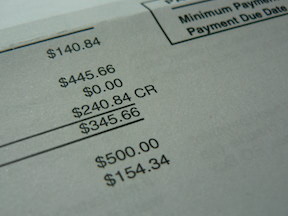

Credit cards work by lending you the money you need now and allowing you to pay it back over time. If, at the end of the monthly billing cycle, you haven’t paid the entire amount that you borrowed, the credit card company will charge you interest. The interest you owe is a percentage of the amount you still owe.

Interest rates are typically high, or around 15 percent on average. The required minimum payment, however, is generally a lower percentage.

This means that, if you only pay the required minimum, it will take you a lot longer to pay off the debt—and you’ll be paying a lot more in interest.

Take this example from the Federal Trade Commission: if you borrow $1,500 at 19 percent interest and only pay the minimum payment (which can be as low as 4 percent of the balance), it will take you more than eight years to pay off the debt. And you’ll also pay an extra $889 in interest. In total, you’ll be paying $2,389 for goods worth $1,500.

That’s a lot of money wasted on interest that you could have spent on necessities or even fun activities.

If you’re struggling with credit card debt—say, you have a lot of debt and are paying only the minimum or nothing at all—it might be time to think about debt relief.

You have a number of options to help get your debt under control, including talking with your creditors, debt consolidation, debt settlement, and bankruptcy. Consider talking with an experienced Louisville bankruptcy lawyer to decide the best route for you.

Speak Your Mind